Apple Pay Launching in Canada With American Express on November 17

Apple Pay is expected to expand to its third market this week, launching in Canada this Tuesday, November, 17, reports iPhone in Canada. As previously announced, Apple Pay will be launching through an exclusive partnership with American Express, initially limiting the reach of Apple's payments service in the country.

According to American Express, the service is set to launch this Tuesday, November 17, 2015. Customer service representatives we spoke with confirmed the date over the phone numerous times, and is in line with what you’ve told us as well.

As reported by The Globe and Mail last month, sources indicate Apple partnered with American Express in order to expedite the Apple Pay launch in the country, as discussions with the major Canadian banks and other credit card companies had been "dragging."

Beyond Canada, Apple is also partnering with American Express to bring Apple Pay to Australia by the end of the year and to Spain, Singapore, and Hong Kong next year. Apple Pay launched in the United States alongside iOS 8 in September 2014 and expanded to the United Kingdom in July of this year.

Popular Stories

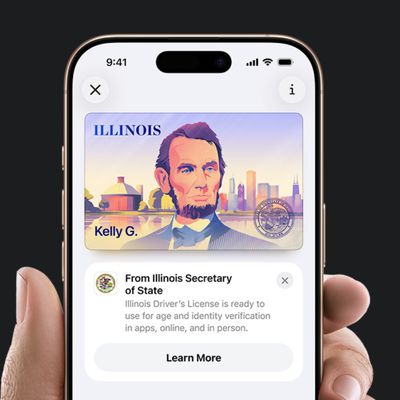

In select U.S. states, residents can add their driver's license or state ID to the Apple Wallet app on the iPhone and Apple Watch, and then use it to display proof of identity or age at select airports and businesses, and in select apps.

The feature is currently available in 13 U.S. states and Puerto Rico, and it is expected to launch in at least seven more in the future.

To set up the...

While the iPhone 18 Pro and iPhone 18 Pro Max are not expected to launch for another nine months, there are already plenty of rumors about the devices.

Below, we have recapped 12 features rumored for the iPhone 18 Pro models.

The same overall design is expected, with 6.3-inch and 6.9-inch display sizes, and a "plateau" housing three rear cameras

Under-screen Face ID

Front camera in...

Apple hasn't updated the Apple TV 4K since 2022, and 2025 was supposed to be the year that we got a refresh. There were rumors suggesting Apple would release the new Apple TV before the end of 2025, but it looks like that's not going to happen now.

Subscribe to the MacRumors YouTube channel for more videos.

Bloomberg's Mark Gurman said several times across 2024 and 2025 that Apple would...

2026 is almost upon us, and a new year is a good time to try out some new apps. We've rounded up 10 excellent Mac apps that are worth checking out.

Subscribe to the MacRumors YouTube channel for more videos.

Alt-Tab (Free) - Alt-Tab brings a Windows-style alt + tab thumbnail preview option to the Mac. You can see a full window preview of open apps and app windows.

One Thing (Free) -...

Earlier this month, Apple released iOS 26.2, following more than a month of beta testing. It is a big update, with many new features and changes for iPhones.

iOS 26.2 adds a Liquid Glass slider for the Lock Screen's clock, offline lyrics in Apple Music, and more. Below, we have highlighted a total of eight new features.

Liquid Glass Slider on Lock Screen

A new slider in the Lock...

Apple's first foldable iPhone, rumored for release next year, may turn out to be smaller than most people imagine, if a recent report is anything to go by. According to The Information, the outer display on the book-style device will measure just 5.3 inches – that's smaller than the 5.4-inch screen on the iPhone mini, a line Apple discontinued in 2022 due to poor sales. The report has led ...

Apple reportedly tested a version of the first-generation AirPods with bright, iPhone 5c-like colored charging cases.

The images, shared by the Apple leaker and prototype collector known as "Kosutami," claim to show first-generation AirPods prototypes with pink and yellow exterior casings. The interior of the charging case and the earbuds themselves remain white.

They seem close to some...

Samsung is working on a new foldable smartphone that's wider and shorter than the models that it's released before, according to Korean news site ETNews. The "Wide Fold" will compete with Apple's iPhone Fold that's set to launch in September 2026.

Samsung's existing Galaxy Z Fold7 display is 6.5 inches when closed, and 8 inches when open, with a 21:9 aspect ratio when folded and a 20:18...

With the end of 2025 near, the time has come to look back at the devices and accessories that Apple discontinued throughout the year.

Most of the products that were discontinued this year were simply replaced by a new model with an updated chip. However, the iPhone SE line was entirely discontinued when the iPhone 16e launched, and the iPhone Plus line is being phased out.

Below, we have...