Apple Pay Gains Support for Citi Monthly Payment Plans

Apple Pay now supports Citi Flex Pay, allowing U.S. Citi credit card holders to pay for Apple Pay purchases over time with the Flex Pay option.

Citi Flex Pay is available for Apple Pay purchases over $75. The default payback period is three months, but there are longer payback durations available with a monthly fee. Flex Pay can be used when making purchases on websites or in apps.

To use Citi Flex Pay, an eligible Citi credit card needs to be added to Apple Pay. When making a purchase, select the Citi credit card and then tap on "Pay Later." From there, select a Citi Flex Pay option.

Apple previously had its own buy now, pay later service called Apple Pay Later, but it was discontinued last year. Apple now partners with third-party providers for pay over time options. Apple's other U.S. partners include Affirm, Klarna, and Synchrony.

Popular Stories

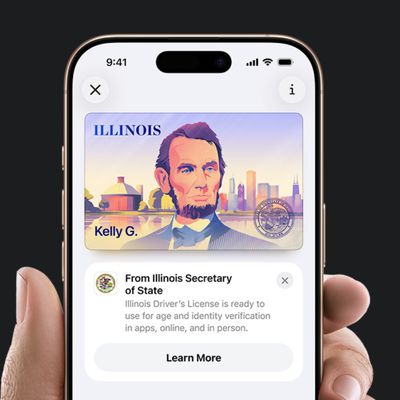

In select U.S. states, residents can add their driver's license or state ID to the Apple Wallet app on the iPhone and Apple Watch, and then use it to display proof of identity or age at select airports and businesses, and in select apps.

The feature is currently available in 13 U.S. states and Puerto Rico, and it is expected to launch in at least seven more in the future.

To set up the...

While the iPhone 18 Pro and iPhone 18 Pro Max are not expected to launch for another nine months, there are already plenty of rumors about the devices.

Below, we have recapped 12 features rumored for the iPhone 18 Pro models.

The same overall design is expected, with 6.3-inch and 6.9-inch display sizes, and a "plateau" housing three rear cameras

Under-screen Face ID

Front camera in...

Earlier this month, Apple released iOS 26.2, following more than a month of beta testing. It is a big update, with many new features and changes for iPhones.

iOS 26.2 adds a Liquid Glass slider for the Lock Screen's clock, offline lyrics in Apple Music, and more. Below, we have highlighted a total of eight new features.

Liquid Glass Slider on Lock Screen

A new slider in the Lock...

Apple hasn't updated the Apple TV 4K since 2022, and 2025 was supposed to be the year that we got a refresh. There were rumors suggesting Apple would release the new Apple TV before the end of 2025, but it looks like that's not going to happen now.

Subscribe to the MacRumors YouTube channel for more videos.

Bloomberg's Mark Gurman said several times across 2024 and 2025 that Apple would...

2026 is almost upon us, and a new year is a good time to try out some new apps. We've rounded up 10 excellent Mac apps that are worth checking out.

Subscribe to the MacRumors YouTube channel for more videos.

Alt-Tab (Free) - Alt-Tab brings a Windows-style alt + tab thumbnail preview option to the Mac. You can see a full window preview of open apps and app windows.

One Thing (Free) -...

Samsung is working on a new foldable smartphone that's wider and shorter than the models that it's released before, according to Korean news site ETNews. The "Wide Fold" will compete with Apple's iPhone Fold that's set to launch in September 2026.

Samsung's existing Galaxy Z Fold7 display is 6.5 inches when closed, and 8 inches when open, with a 21:9 aspect ratio when folded and a 20:18...

The European Commission today praised the interoperability changes that Apple is introducing in iOS 26.3, once again crediting the Digital Markets Act (DMA) with bringing "new opportunities" to European users and developers.

The Digital Markets Act requires Apple to provide third-party accessories with the same capabilities and access to device features that Apple's own products get. In iOS...

Apple is working on a foldable iPhone that's set to come out in September 2026, and rumors suggest that it will have a display that's around 5.4 inches when closed and 7.6 inches when open. Exact measurements vary based on rumors, but one 3D designer has created a mockup based on what we've heard so far.

On MakerWorld, a user named Subsy has uploaded a 1:1 iPhone Fold replica (via Macworld), ...

With the end of 2025 near, the time has come to look back at the devices and accessories that Apple discontinued throughout the year.

Most of the products that were discontinued this year were simply replaced by a new model with an updated chip. However, the iPhone SE line was entirely discontinued when the iPhone 16e launched, and the iPhone Plus line is being phased out.

Below, we have...