The interest rate on Apple Card's savings account was today lowered from 3.75% to 3.65%—an all-time low.

The drop follows the last interest rate cut in March, where it reduced from 3.9% to 3.75%. If you deposited $1,000 into the account, and maintained that balance for one year, you would earn $36.50 in interest based on the current annual percentage yield (APY).

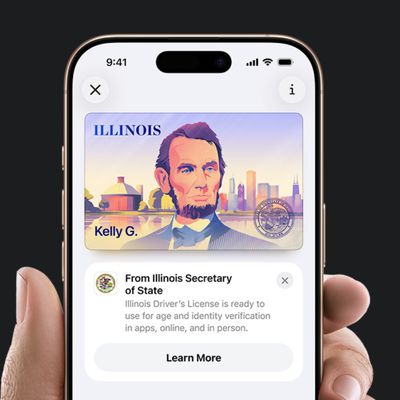

Apple introduced its high-yield savings account in April 2023 in partnership with Goldman Sachs. Available in the Wallet app on the iPhone, the account features no fees, no minimum deposit, and no minimum balance requirements. To be eligible, users must have an Apple Card, reside in the U.S., and be at least 18 years old.

The account enables Apple Card users to earn interest on both their Daily Cash rewards and any additional funds deposited via a linked bank account or Apple Cash. The balance cap was raised to $1 million, up from the previous limit of $250,000.

At launch, the APY was set at 4.15%, but it has varied in response to U.S. Federal Reserve rate changes. It reached a peak of 4.5% in early 2024, while the current rate sits at a record low of 3.65%.

In an email to Apple Card users, Apple explains the reason for the adjustment and highlights that the rate remains well above that of standard savings accounts:

Why did the APY on Savings change?

The APY on Savings is variable, and we may change rates at any time. Rates are influenced by many factors, including the Federal Reserve Funds Rate. When this rate is lowered, it affects all US financial institutions and we evaluate potential adjustments to our rates.

Our current APY remains 8X the national average and we will continue to strive to keep it competitive.

To get started with Apple's savings account, open the Wallet app, select your Apple Card, tap the three-dot icon, go to Daily Cash, and tap "Set Up" next to Savings.

While Goldman Sachs is reportedly looking to exit its partnership with Apple early, it remains unclear whether this will impact current Apple Card users. Recent reports indicate that Barclays, Synchrony, and JPMorgan Chase are among the contenders to become the new financial partner.